Accelerate Deal Flow: Investment Virtual Assistant for Portfolio Managers

Get an EU-based investment virtual assistant who handles CEO and founder responsibilities – email management, investor relations, team coordination – while understanding your deal processes, market dynamics, and portfolio management demands that come with running an investment firm.

The Hidden Returns Killer Every Investment Manager Faces

You’re supposed to be identifying winning investments and maximizing returns. Instead, you’re buried under LP reporting requirements and due diligence coordination. Your inbox overflows with deal summaries that need organizing. Your calendar is a patchwork of investor calls that somehow never align with your analysis schedule.

The Reality: Most investment managers are losing 60+ hours monthly to administrative tasks that don’t generate alpha or strengthen LP relationships.

The Solution: An investment virtual assistant who handles your CEO workload while understanding your deal processes, reporting cycles, and portfolio management demands.

Turn Administrative Time Into Analysis Time:

- Reclaim 60+ Hours Monthly for deal evaluation and portfolio strategy

- Never Miss Another Investment Opportunity with organized deal flow management

- Keep LPs Confident with timely, professional performance updates

- Scale Personal Life Too with comprehensive personal admin support

- Understand Investment Rhythms without explaining why quarter-end closes matter

The best part?

You don’t need to explain what IRR, due diligence, or LP commitments mean. They already speak your language.

Let’s talk about how we can transform your operational chaos into strategic clarity.

Stop Losing Returns to Administrative Chaos: Get Your Time Back to Invest

If you want to move your investment firm forward, a five-dollar-per-hour VA who just organizes spreadsheets isn’t going to cut it.

You need somebody who becomes your complete operational partner – handling everything from investor communications to deal coordination to personal life management.

To deliver that level of support, our partnership follows a proven phased approach that builds trust and delivers value from day one:

Phase 1:

Observation & Quick Wins

Your EA starts by understanding your complete operational ecosystem. They'll shadow your email management, meeting coordination, and personal calendar while also learning your deal evaluation process, LP communication patterns, and portfolio reporting requirements. The first goal is to identify immediate bottlenecks across ALL areas and provide instant relief.

Phase 2:

Systematizing Your Operations

Your EA builds comprehensive SOPs covering both executive and investment operations. They'll document everything from LP meeting preparation and travel planning to due diligence workflows and quarterly reporting processes, creating scalable systems across your entire leadership role.

Phase 3:

Proactive Management & Strategic Support

With systems in place, your EA becomes truly proactive. They'll prep your investor materials while coordinating due diligence schedules, manage your personal travel while tracking fund reporting deadlines, ensuring all aspects of your CEO and operational responsibilities run seamlessly.

Phase 4:

Full Operational Ownership

Your EA takes complete ownership of your operational ecosystem. You can focus entirely on investment strategy and portfolio performance while they handle everything from LP communications and team coordination to compliance documentation and conference logistics.

Why Investment Managers Choose DonnaPro's Elite Executive Assistants

We only work with CEOs and founders, and we know how selective you are. That’s exactly why we only hire the top 1% of executive assistants in Europe.

These assistants are problem solvers by nature. Whatever you throw at them, they’ll know how to handle it.

Because of this, CEOs and founders trust them with a wide range of responsibilities. In fact, more than 50 different types of tasks are regularly delegated to our assistants, from email management and investor relations to personal errands, project management, and much more.

Within that broad scope, certain tasks stand out for specific types of entrepreneurs. For investment managers in particular, the ones that bring the biggest leverage are:

- Deal Flow Management: Organize investment opportunities, coordinate due diligence schedules, and manage the pipeline so you can focus on evaluation and decision-making

- Investor Relations Excellence: Prepare LP updates, coordinate investor meetings, and manage ongoing communication while maintaining professional standards

- Portfolio Administration: Handle performance reporting logistics, coordinate with fund administrators, and manage operational workflows that keep your fund compliant

- Executive Travel: Handle all logistics so you can focus on investment conferences, LP meetings, and portfolio company board meetings

- Personal Life Management: Maintain work-life balance while managing investments - because burnout kills more funds than market downturns

Want to explore all the ways an EA can support your growth? Visit our complete services page to see the full scope of what’s possible.

Result: You focus on generating returns while your investment virtual assistant ensures everything else operates smoothly.

What Makes Our Virtual Executive Assistants Your Highest ROI Driving Team Member?

Donna saves you up to 60 hours per month

Count on saving up to 60 hours monthly with our virtual executive assistants, backed by unparalleled expert teams.

Donna is married to AI tools

Our executive assistants are real people. Real people who master AI tools and are therefore effective as squirrel hoarding nuts for winter.

Donna serves only CEO’s and founders

Executive assistance tailored only for CEO’s & founders. Not for freelancers, not for teams… for YOU.

Donna is remote

Say goodbye to concerns about office space, payroll taxes, equipment costs, and administrative burdens. Our fully remote team handles everything seamlessly - even ordering the perfect cup of coffee for you.

Donna is safe & secure

DonnaPro’s EA’s follow strict confidentiality protocols and are GDPR compliant. Every assistant is rigorously vetted, and security measures are formalized in every agreement. Think of our security like a high-tech vault—reinforced walls, locked tight, with access granted only to those you trust.

Donna is from the European Union

Our entire team is proudly based in the European Union, but our virtual assistant services know no borders. Whether you’re in Italy, Sweden, Germany, or currently living in Asia or Africa, we’d love to meet you.

Donna is not “pushing for the ring”

While most similar companies lock you into a 3-month contract, we differ. Enjoy our zero-commitment policy for the first 60 days and see the difference for yourself.

Donna masters your industry

Yes, your business is indeed unique. However, we've worked across 110+ industries and are confident we can help you, too.

*No Commitment for the first 2 months. Zero Risk.

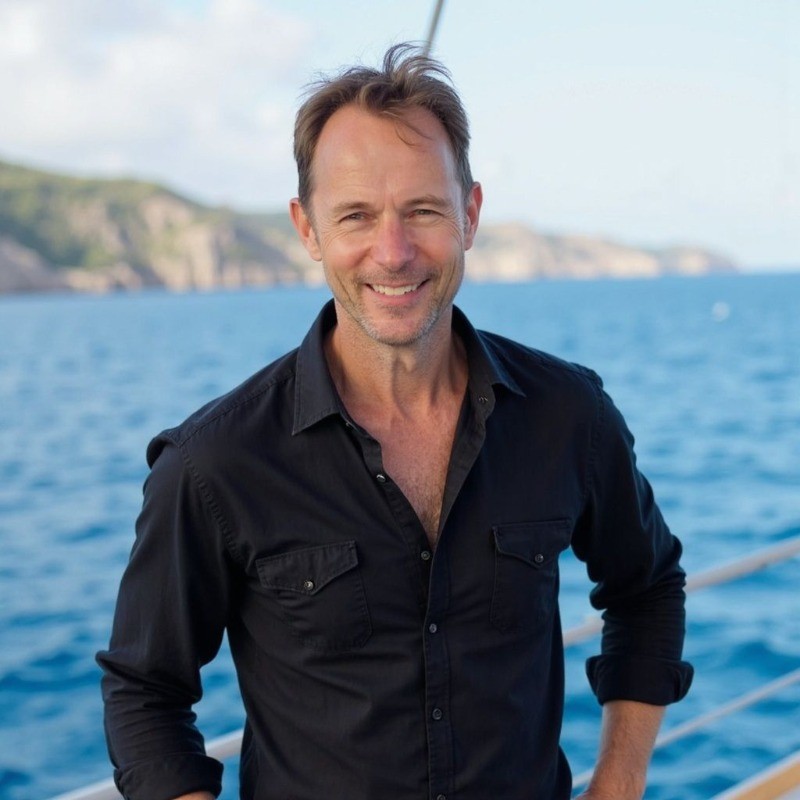

Real Results from European CEOs & Leaders

How An Investment Virtual Assistant Helps Advisors Scale

Claim Your Free Strategy Session

Book your no-obligation strategy call here where we'll discuss your specific investment management challenges and explore how an EA could transform your daily operations.

Get Matched with Your Donna

We connect you with a pre-vetted EA who has the skills to thrive in your world.

Seamless Onboarding

Your EA integrates into your workflow, backed by our internal playbooks and support team.

Reclaim Your Time

Start delegating from day one and focus on what you do best - finding and managing winning investments.

We Also Support Leaders In:

Drive industrial output and operational excellence with a manufacturing virtual assistant who understands production environments. Master supplier relationships, production scheduling, and operational coordination while you focus on innovation and market leadership.

Keep supply chains moving efficiently with a logistics virtual assistant who thrives on operational complexity. Transform shipment tracking, carrier coordination, and communication management into competitive advantages while you focus on strategic growth and expansion.

Build a thriving educational platform with an education virtual assistant who amplifies your teaching impact. Perfect course scheduling, instructor coordination, and administrative workflows while you focus on creating transformational learning experiences that shape futures.

Create unforgettable experiences with an event planning virtual assistant who perfects every detail. Transform vendor management, logistics coordination, and guest relations from overwhelming complexity into seamless execution that builds your reputation.

Keep creative projects on track and under budget with a media virtual assistant who understands entertainment industry demands. Master production scheduling, talent coordination, and administrative excellence while you focus on creating content that captivates audiences.

Scale your online empire with an ecommerce virtual assistant who drives operational excellence across every channel. Transform supplier communications, marketing coordination, and logistics management into competitive advantages while you focus on product innovation and market expansion.

Build projects faster and more profitably with a construction virtual assistant who understands your complex workflows. Master project timelines, contractor coordination, and client communication from blueprint to completion while you focus on delivering architectural excellence.

Close more deals and maximize commission revenue with a real estate virtual assistant who accelerates your sales cycle. Transform client communications, property listing coordination, and transaction management from time-consuming tasks into profit-generating systems.

Build a thriving wellness empire with a fitness-focused virtual assistant who understands your passion for transformation. Perfect client bookings, workshop coordination, and operational excellence while you focus on changing lives through health and wellness mastery.

Navigate complex healthcare regulations while accelerating innovation using a healthcare virtual assistant specialized in medical environments. Streamline research documentation, clinical coordination, and regulatory compliance while you focus on advancing treatments that save lives.

Increase billable hours while focusing on high-value cases using a legal virtual assistant trained in law firm operations. Master case coordination, client scheduling, and administrative workflows with complete understanding of legal confidentiality and court deadlines—your secret weapon for practice growth.

Win more retainers and deliver campaigns faster with a marketing agency virtual assistant who understands creative workflows. Transform client communication, project coordination, and proposal delivery from operational overhead into growth catalysts while you craft breakthrough strategies.

Scale to 7-figures without burning out using a coaching virtual assistant who amplifies your transformational impact. Master client onboarding, proposal creation, and calendar optimization while you focus on delivering life-changing results that command premium pricing.

Navigate the rapidly evolving fintech landscape with a crypto-savvy virtual assistant who speaks your language. Conquer regulatory complexity, development coordination, and stakeholder management while you build the financial infrastructure of tomorrow.

Close more deals and accelerate portfolio growth with a startup virtual assistant who thrives in fast-moving environments. Transform deal coordination, LP communications, and due diligence scheduling from bottlenecks into competitive advantages while you source the next unicorn.

Accelerate deal flow and portfolio performance with an investment virtual assistant who turns operational complexity into strategic advantage. Seamlessly organize opportunities, prepare investor communications, and manage administrative excellence while you identify and capture market-winning investments.

Scale your practice without sacrificing client relationships using a financial advisor virtual assistant who elevates every interaction. Master complex scheduling, confidential correspondence, and meeting orchestration while you build portfolios and forge lasting wealth-building partnerships.

Maximize billable hours and close enterprise deals faster with an IT virtual assistant who understands your high-stakes environment. Transform vendor coordination, compliance documentation, and client communications from time drains into profit drivers while you focus on delivering cutting-edge solutions.

Turn breakthrough research into market-dominating revenue with AI virtual assistant services designed for visionary leaders. Your assistant becomes the operational backbone managing stakeholder relations, funding coordination, and strategic admin – so you can focus on innovations that reshape entire industries.

Hit your next MRR milestone faster with a SaaS virtual assistant who transforms operational chaos into growth acceleration. While you innovate and acquire customers, your dedicated assistant conquers investor updates, board presentations, and strategic coordination – turning administrative burden into competitive advantage.

FAQs About Investment Virtual Assistant Services for Leaders

Is this just for investment tasks, or do you handle everything?

Your DonnaPro investment virtual assistant becomes your complete executive partner. While they understand investment operations, they primarily handle your CEO responsibilities: email management, calendar coordination, investor relations, project management, personal tasks, and strategic admin. The investment knowledge is just one part of their comprehensive support – they’re executive assistants for CEOs who happen to run investment management businesses.

Can my EA manage both my business operations AND personal life?

Absolutely. Our EAs handle everything from scheduling your LP meetings and managing your inbox to booking personal travel and organizing family events. They’re trained to seamlessly switch between business-critical tasks and personal administration.

How is this different from hiring an investment analyst or researcher?

DonnaPro is a European virtual assistant agency that exclusively works with investment managers and portfolio leaders, offering executive support beyond financial analysis. While other services focus on research tasks or data management, we handle your complete operational leadership – from LP communications and deal coordination to personal life management – while understanding investment cycles and due diligence processes.

What if I need help with things outside of investment management?

That’s exactly what we do. Your EA handles investor relations, business development, HR coordination, content creation, market research, travel planning, and personal administration. Investment knowledge is just one tool in their comprehensive skill set.

Do they understand both the business side AND the regulatory requirements in investment management?

Yes. They’re trained in executive support fundamentals (email management, meeting coordination, business operations) AND investment management business practices. They understand LP communication standards, regulatory considerations, and professional expectations in the investment world. This dual competency means they can prepare your fund performance summary in the morning and coordinate your due diligence schedule in the afternoon.

What's the ROI of hiring DonnaPro for my investment management business?

Most investment managers report improved investor satisfaction, better operational consistency, and reduced administrative burden that enables deeper focus on investment analysis and portfolio management. This typically translates to more thorough deal evaluation and stronger investor relationships. The investment pays for itself through enhanced operational efficiency and improved fund performance.